iowa state income tax calculator 2019

Revenue Department of Preview. 2019 IA 1040 TAX TABLES For All Filing Statuses To find your tax.

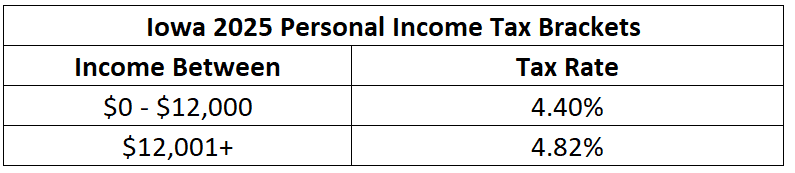

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

PDF Individual Income Tax Report.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Iowa Individual Income Tax Statistical Report 2019. The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax.

11 rows individual income tax standard deductions. How to calculate Federal Tax based on your Annual Income. 2019 Iowa Individual Income Tax Annual Statistical Report 2019.

To find out if you. If the amount you owe line 70 is large you may wish to check the. Compare your take home after tax and estimate your tax return.

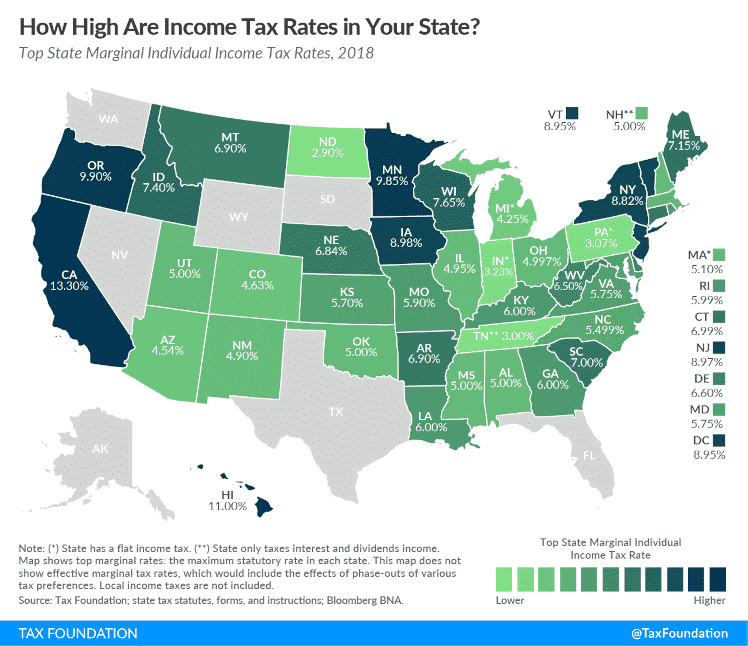

How to Calculate 2019 Iowa State Income Tax by Using State Income Tax Table. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. The states income tax rates range from 033 to 853.

Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your. SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. Discover Helpful Information And Resources On Taxes From AARP.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. The 2019 Tax Calculator uses the 2019 Federal Tax Tables and 2019 Federal Tax Tables you can view the latest tax tables and. 2019 Iowa Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China. Ad Download or Email IA 1040 More Fillable Forms Register and Subscribe Now. The Iowa State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Iowa State Tax CalculatorWe also provide State Tax.

This credit is available only to taxpayers who qualify for the federal Earned Income Tax Credit EITC. See What Credits and Deductions Apply to You. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets.

Iowa has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income. Iowa Paycheck Calculator.

Your average tax rate is 1198 and your marginal tax rate is 22. The Iowa Earned Income Tax Credit is a refundable credit. The median household income is.

Iowa Income Tax Calculator 2021. Enter other state and local income taxes not including Iowa state income taxes on line 4a OR general sales. About Iowa income tax withholding.

If line 66 is less than line 58 subtract line 66 from line 58 and enter the difference. For tax year 2019 the standard deduction is. Find your pretax deductions including 401K flexible account.

Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040. Click for the 2019 State Income Tax Forms. If you would like to update your Iowa withholding.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Fields notated with are required. The state income tax system in Iowa is a progressive tax system.

Include your 2019 Income Forms with your 2019 Return. Use Our Free Powerful Software to Estimate Your Taxes. Ad Enter Your Tax Information.

In addition to the exemption provisions above if you were a nonresident or part-year resident and had net income from Iowa sources of less than 1000 see note below you are exempt from. Find your income exemptions.

International Benchmarks For Corn Production Farmdoc Daily

College Football Spreadsheet Business Template Business Plan Template Football Pool

Iowa Income Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Iowa Paycheck Calculator Smartasset

University Of Iowa Provost Steps Down Effective Immediately

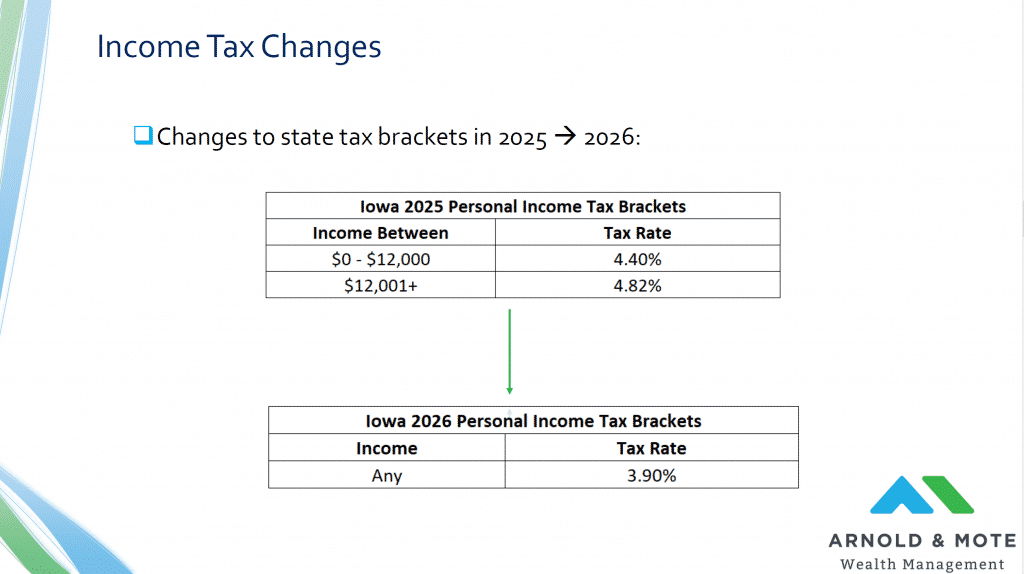

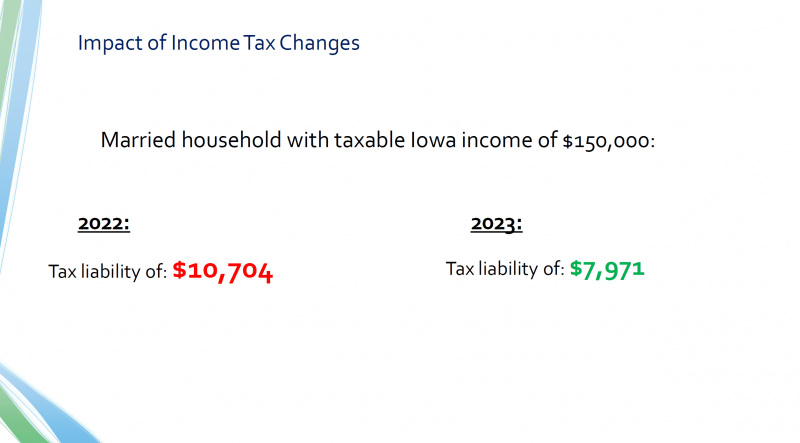

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Usda S Season Average Commodity Prices Ag Decision Maker

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Iowa Estate Tax Everything You Need To Know Smartasset

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Tax Law Makes Some Changes Now But Others Are Far Off And Contingent Center For Agricultural Law And Taxation

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Proposed Gop Budget For State Universities Is Less Than 20 Years Ago Iowa Capital Dispatch

Iowa Farmland Rental Rates 1994 2022 Usda Ag Decision Maker

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

How Do State And Local Individual Income Taxes Work Tax Policy Center

Understanding The Economics Of Tile Drainage Ag Decision Maker